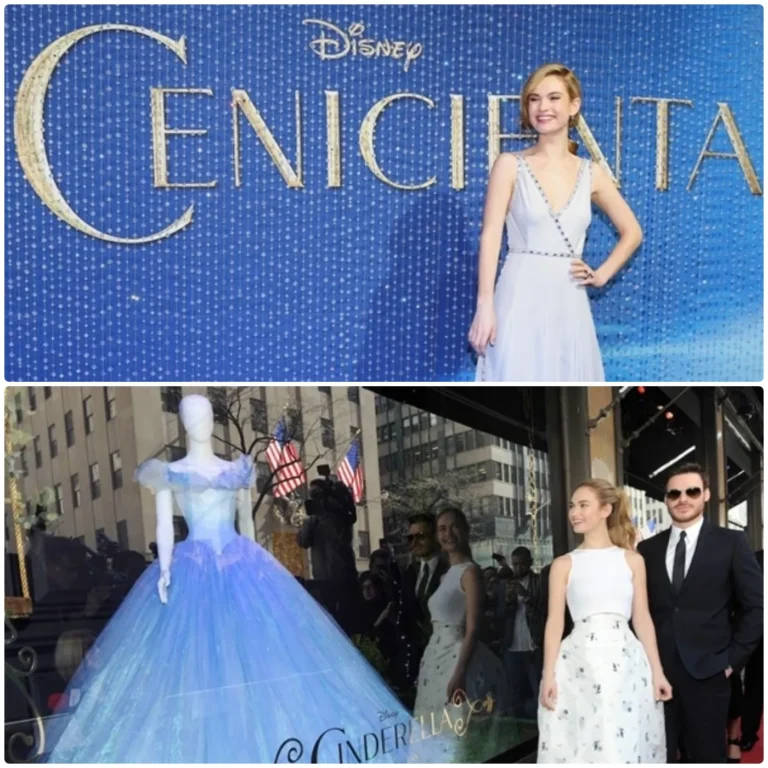

In a stunning revelation, former Intel CEO Paul Otellini aimed to spend $20 billion to acquire Nvidia back in 2005, a move that would have significantly altered the landscape of the technology sector. This unexpected proposal came to light through a New York Times report citing two sources familiar with the situation, highlighting Otellini’s vision of Nvidia’s potential role in the data center market. At the time, Nvidia had just surpassed Apple to become the world’s most valuable company, making the proposal all the more intriguing.

The 2005 Proposal and Board Reactions

During a board meeting in 2005, Otellini articulated his belief that Nvidia’s innovative designs could be crucial for Intel’s future in data centers. However, despite his strong advocacy, the board members were largely opposed to the acquisition due to the hefty $20 billion price tag—a staggering sum two decades ago. Had the deal gone through, it would have marked one of the most expensive technology acquisitions in American history.

Instead of pursuing the acquisition, Intel’s board pivoted towards developing an internal graphics processing system called Larabee, spearheaded by Pat Gelsinger, the current CEO of Intel. Larabee was intended to utilize Intel’s x86 architecture, combining CPU and GPU capabilities. Ultimately, the project was shelved, although Intel later revisited graphics technology with initiatives like Xe and Arc.

Intel’s Missed Opportunities in the AI Sector

In the realm of artificial intelligence, Intel has attempted several mergers, including Nervana Systems and Movidius in 2016, as well as Habana Labs in 2019. However, these acquisitions pale in comparison to Nvidia’s current stature, with a market capitalization exceeding $3.53 trillion as of October 25, 2024—just surpassing Apple’s $3.52 trillion valuation.

The indecisive moves made by Intel’s leadership over the years have led to missed opportunities in the burgeoning AI market, leaving the company at risk of being outpaced by competitors. According to Tom’s Hardware, Intel has faced continuous challenges in its manufacturing and sales strategies, leading to a market capitalization of under $100 billion—far smaller than Nvidia and even less than the wealth of Nvidia’s CEO, Jensen Huang.

A Pattern of Missed Opportunities

This isn’t the first instance where Intel missed a significant opportunity to enter the AI market early. In 2017 and 2018, Intel was approached about purchasing a stake in OpenAI when it was still a fledgling nonprofit research organization. At the time, Intel CEO Bob Swan declined the offer, believing that AI models were not yet ready for widespread adoption.

Reflecting on Otellini’s tenure, which lasted from 2005 to 2013, he joined Intel in 1974 and was instrumental in shaping its direction. His untimely death in 2017 at the age of 66 left a legacy of what could have been had his bold vision materialized.

The $20 billion acquisition proposal by Paul Otellini serves as a cautionary tale of missed opportunities and the volatile nature of the tech industry. As Nvidia continues to thrive and dominate the AI market, Intel’s struggle to regain its footing highlights the critical importance of strategic decision-making in technology. The impact of these decisions echoes through the industry, emphasizing the need for forward-thinking leadership to capitalize on emerging trends and innovations.